[ad_1]

Surely someone already sees the possibility of retirement just around the corner and you are hesitant to know how much pension you will receive given your Social Security contribution. This would help to know the exact moment (given your purchasing power) to make the decision, but always with the peace of mind that the remaining pension will be enough for your day to day.

It is because in this article you will see how to run a simulationentering basic personal data, with the aim of calculating your pension as a guide.

First qualify that in 2023, this is the age legal ordinary retirement based on your contribution:

- Proving less than 37 years and 9 months of contribution, retirement can be made at 66 years and 4 months.

- If you are 37 years old and have a contribution period of 9 months (or more), the withdrawal can be obtained with a age 65 years old.

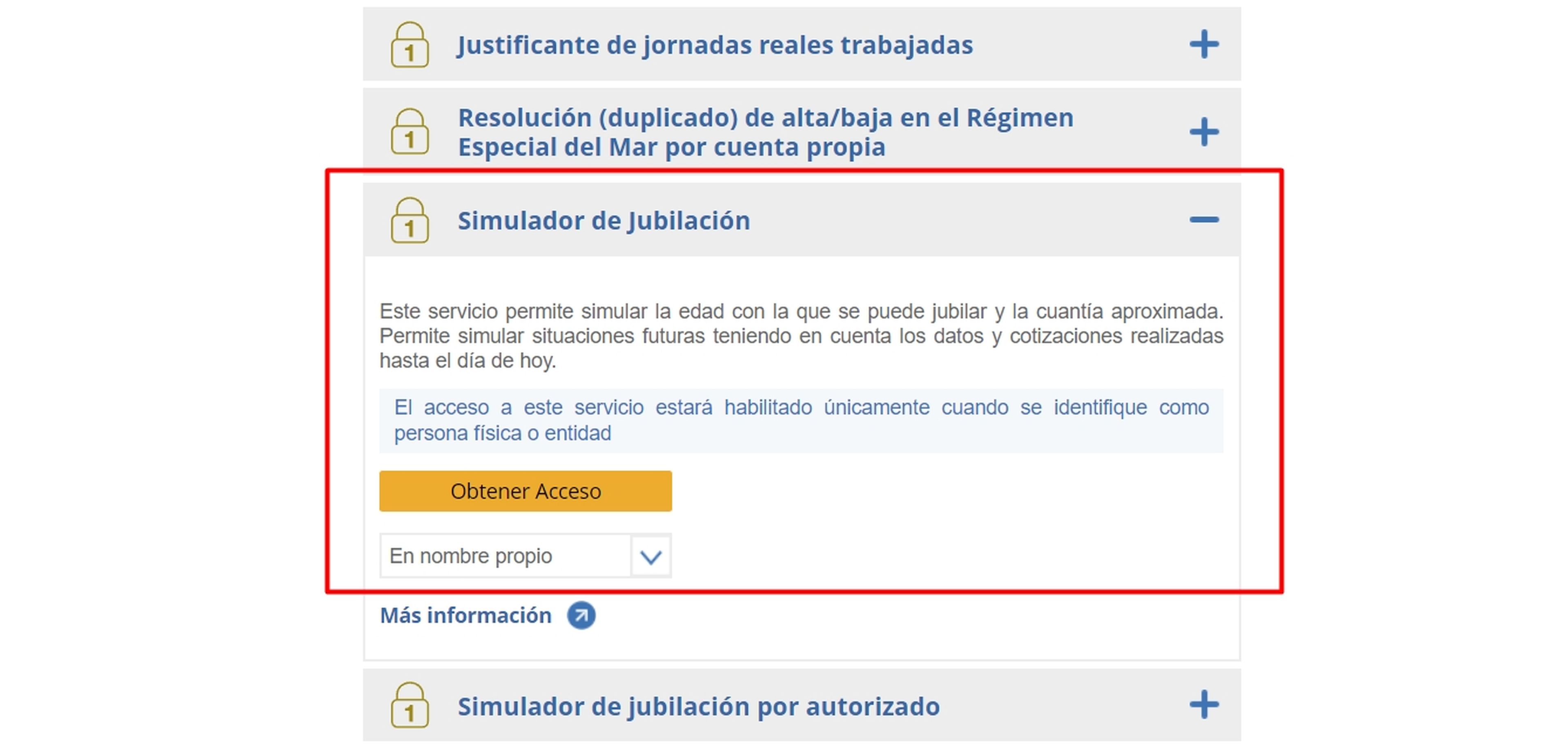

The Social Security website has a retirement simulator, which you can access and identify yourself. You can do it with your electronic certificate or Cl@ve, but you can also request that a text message be sent to your mobile (SMS) and fill out a form with your ID, date of birth and telephone number, to receive a security code and be able to enter

This is how the Social Security simulator works to calculate your pension

The first phase is already explained. Previously you will have to have entered the official Social Security website to access the lower part of the page and later to your account. In this case, the process will start through identification by SMS and in your own name.

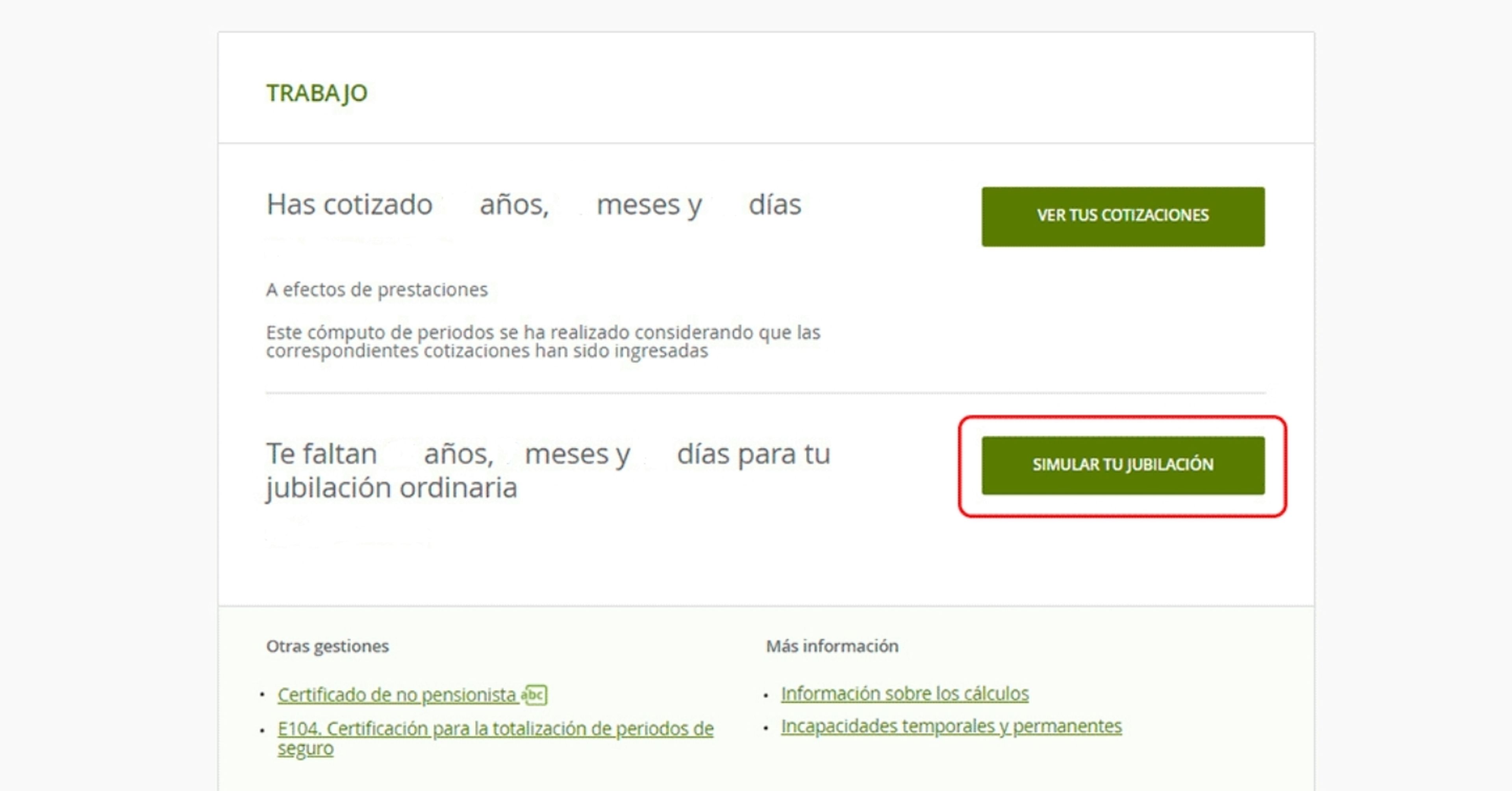

After the identification process, the website will refer you to the simulator retirement. Next, a screen will appear where you can directly see the time you have contributed as a worker. In this case You can select any of the two options (See your contributions and Simulate your retirement to analyze your working life), but, in this case, you must go to the second one.

Once inside the option indicated in the image, will take you to a full display, previous variants (children, disability, gender gap… etc,) established and you will access the simulation through the button provided.

Of course, the aforementioned variations may also be modified in case of suffering any of them. This is really important to keep in mind as the result may vary.

On this final screen You will now be able to directly play, so to speak, with the possible retirement dates, with the aim of seeing how your final pension varies. You will be able to see your quoted days up to the current or future date. Clarify the aspect of future retirement. In this case, an indicative estimate will be made.

Note that at the end of the process you are allowed the ability to generate a PDF with all the established data and, if you have set different dates, more easily compare the results obtained.

Another way to calculate your pension, although more complex

Before going into the subject, let me tell you that this is not the only simulator that you can access. For example, MAPFRE also has a useful calculation tool, less complete, but with some simple data that you surely already know, such as the years of contribution, you will be able to find out your pension.

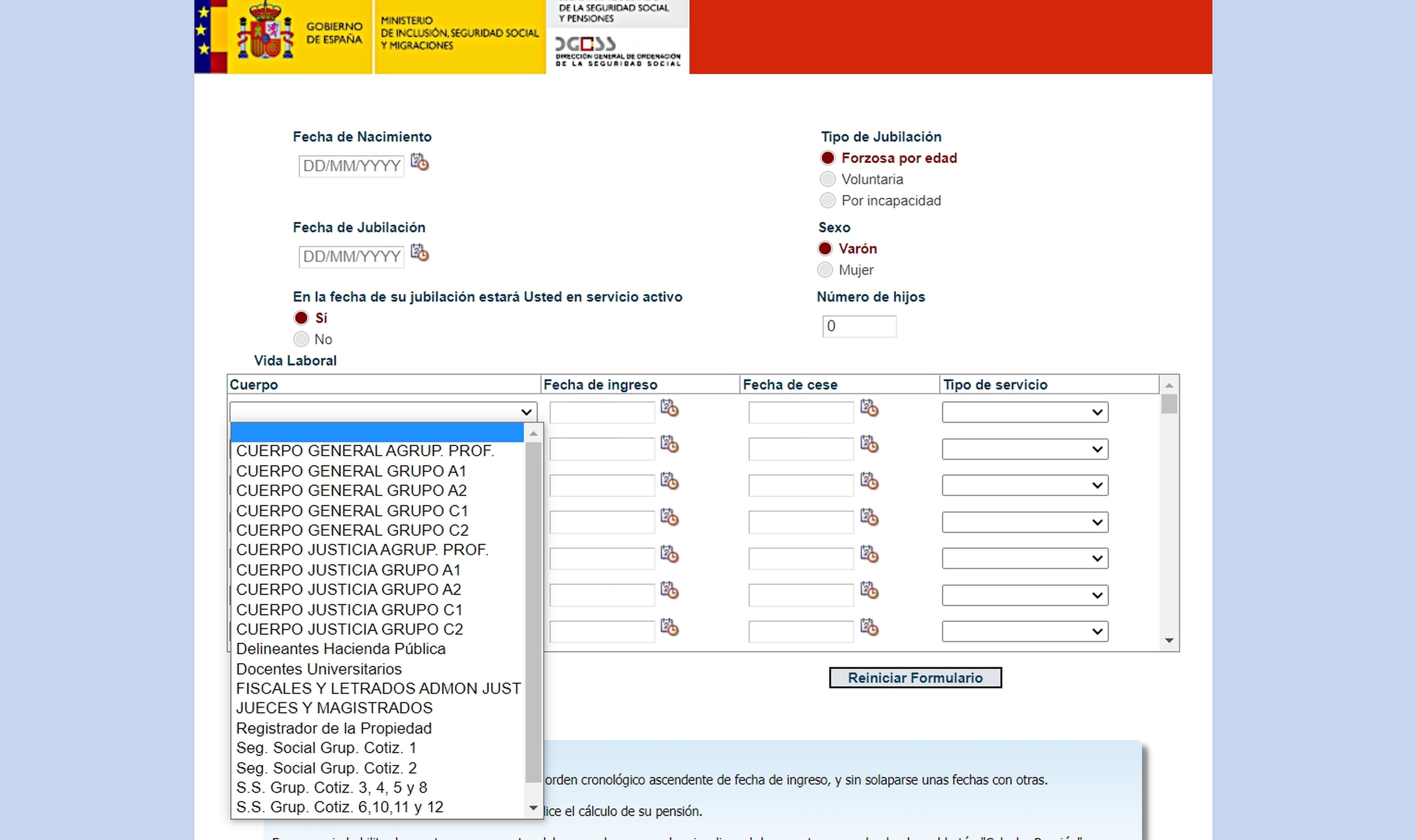

However, to calculate retirement leaving out Social Security data, You have an old tax simulator to carry out the same process. In this case, you must access the official website and select, in this case (assuming that it is the majority), the concept of “Civilians”.

You must enter the data requested by the tool. The complexity here, hence the Social Security has released a simpler simulator, is that, In the “Body” options, you must include how you have quoted in each of the jobs (the most recent the first), as well as the start and end date of the contract.

You must also include the “Type of Service”, either as practices or if the service is still active. After this, all you have to do is click on “Calculate Pension” and you will get guidance that can be key and that will surely clarify many doubts about your retirement.

As you can see, perhaps the easiest way to get a slight idea of how your pension will look in the face of a future and long-awaited retirement, we find it at the beginning with the Social Security tool. By having all your data, you only have to establish certain variants or preferences to obtain a clear simulation.

[ad_2]